Category: Corporate governance case studies

-

Corporate Governance Reforms in Japan, Swiss-Japanese Chamber of Commerce in Geneva

Corporate Governance Reforms: How the Way Japanese Corporations Take Decisions is Changing SJCC Swiss-Japanese Chamber of Commerce Friday 12 October 2018, 18:30-19:45, JETRO Office Geneva Prime Minister Abe’s corporate governance reforms are arguably one of the biggest success stories of his reform program to promote Japan’s economic growth. Japan’s Government in coordination with the Tokyo…

-

Corporate governance reforms in Japan: a talk at the Embassy of Sweden

Corporate governance reforms in Japan Changing the way Japanese corporations are managed: Can it make Japanese iconic corporations great again? A talk by Gerhard Fasol at the Embassy of Sweden organized by the Embassy of Sweden, The Swedish Chamber of Commerce in Japan (SCCJ), and the Stockholm School of Economics Abstract: Changing the way Japanese…

-

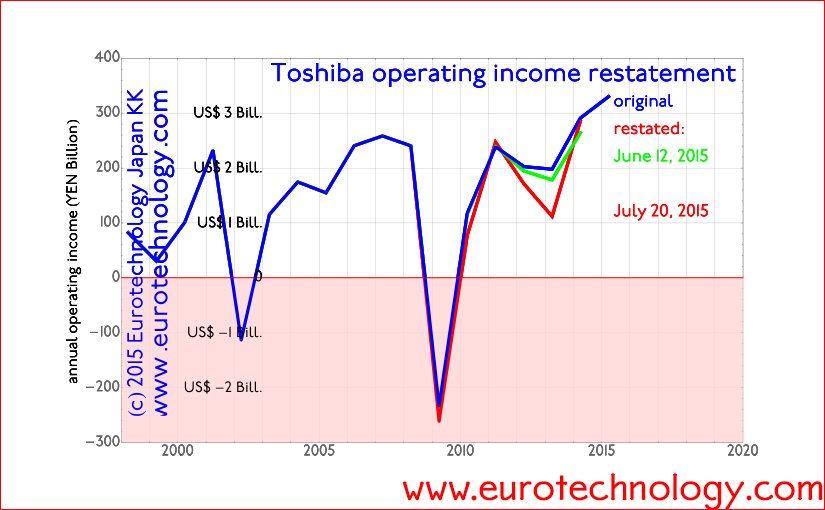

Toshiba income restatement: corporate governance issues

Toshiba’s income restatement announced by the independent 3rd party committee Independent 3rd party committee chaired by former Chief Prosecutor of Tokyo High Court On 12 June, 2015, Toshiba announced corrections to income reports, and at the same time engaged an independent 3rd party investigation committee headed by former Chief Prosecutor at the Tokyo High Court,…